Confused about ITR filing in 2025? Discover how Form 16 and 16A can simplify your online income tax return process. Learn what they contain, where to get them, and how to avoid costly mistakes.

Filing ITR 2025? Don’t Even Start Without These Two Documents

For the tax season of Financial Year 2024-25 (Assessment Year 2025-26) millions of Indian taxpayers are panicking to file Income Tax Returns. What most people miss, however, is this truth in bold —Income Tax Return without Form 16 and Form 16A can be a headache. This is not just meaningless formalities it is important proof of how much tax has been deducted and deposited on your behalf.

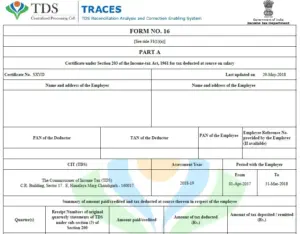

Form 16: The Lifeline for Salaried Taxpayers

For a Salaried individual, Form 16 is your honest to the to tax partner. Given by your employer, it groups your final salary-tax deductions and savings in 80C/80D slabs. It also carries your PAN, TAN of your employer and an incase wise report of deductions paid to government. Atleast it will be valid only if you download from the genuine TRACES portal No handwritten copies allowed.

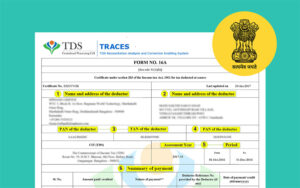

Form 16A: Not Just for Salaried Incomes

Form 16A is the one that one would fill in if you have any income from interest, consultancy, commissions, etc. It is generated by banks/companies/clients on payment before deducting TDS. It’s another paper in this way that tells your earnings have already been taxed and come up in your tax returns.

Double-Check Before Filing: Match It With Form 26AS

A lot of taxpayers in filing on a deadline rush. However, here is the twist… If the numbers in Form 16 or Form 16A are different from Form 26AS, your return will be scrutinized. Form 26AS is a combined Tax Statement available on the TRACES portal which gives the aggregate TDS Form all your Details. Never submit until you reconcile everything.

PhonePe’s Game-Changer: Make UPI Payments Without Internet or Smartphone

Final Word: Don’t Let a Small Error Lead to a Big Tax Notice

Filing your ITR isn’t just a deadline to meet — it’s a declaration of your financial year. Make sure your Form 16 and 16A are accurate, downloaded from TRACES, and aligned with Form 26AS. A little caution now can save you from a year full of tax troubles later.

Kashmir Welcomes Its First Vande Bharat Express: A New Era of Speed and Scenic Travel Begins